This week, Nasdaq announced a push for diversity requirements for company boards, which in its proposal to the SEC presented “an analysis of over two dozen studies that found an association between diverse boards and better financial performance and corporate governance.” The move comes in the same week as U.S. lawmakers vote to “force [foreign] companies with shares traded on American exchanges to finally comply with audit-oversight rules—or leave U.S. markets altogether.” This year’s developments, as it pertains to oversight and accountability, will probably prove the most consequential to stakeholders since the Sarbanes-Oxley Act in 2002, which resulted in Boards of Directors becoming more concerned with governance, risk, and compliance issues.

So, what’s driving this push?

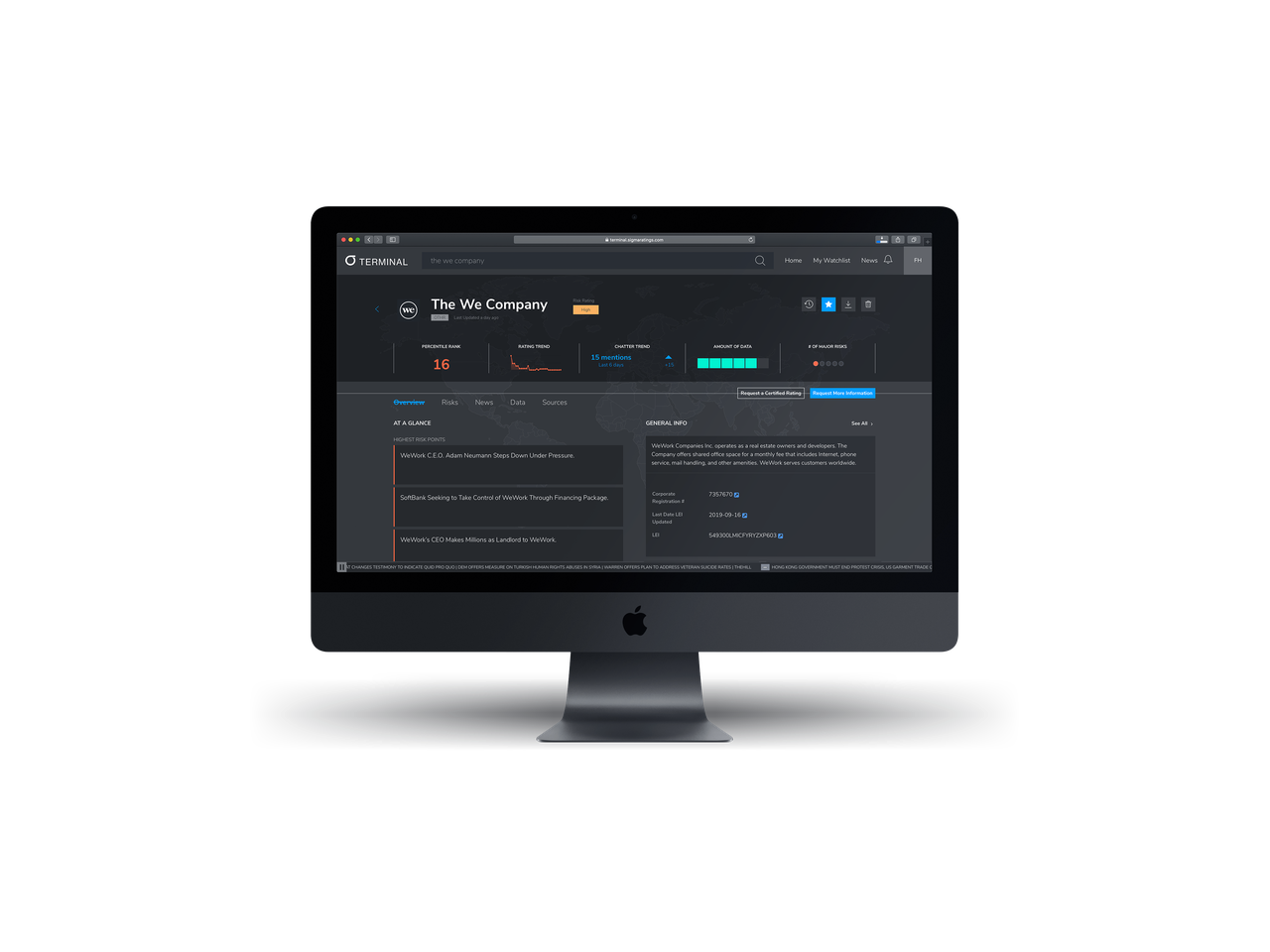

In a recent interview with Bloomberg, Sigma Founder & COO, Gabrielle Haddad, emphasized that “the sentiment in the public from regulators to consumers, to ESG investors -- they’re all becoming much less tolerant of financial crimes and misconduct [and] there’s going to be increased pressure on banks and corporates” to manage non-financial risks that can have serious consequences to all stakeholders. The interview follows Gabrielle’s participation on a panel last month for ELFA 2020 Business LIVE! discussing the implications of COVID-19, which focused on trends in five key areas that are facing fundamental shifts. One of the key areas highlighted how Environmental, Social and Governance (ESG) issues as well as diversity initiatives are becoming more important than ever.

By this point in 2019, the term ESG was used 100% more during S&P 500 earnings calls than the previous quarter. While the absolute number of mentions may be low at the time, if it continues on that trajectory then approximately “20% of calls will proactively cite nonfinancial, ESG data” by this quarter’s earnings call. While the standards may “rely on research that is far from settled,” the foundation of utilizing non-financial information to assess an entity’s viability has proven invaluable. For instance, Deutsche Bank had previously released a study that “mapped 1,600 stocks and millions of company announcements and climate-related media reports over two decades.”. The findings suggested that companies that had a “greater proportion of positive announcements and press over the preceding 12 months outperformed the MSCI World Index by 1.4% a year, on average, while those with more negative news underperformed by 0.3%.” The research appears to support a more comprehensive look at non-financial data beyond environmental, social, and governance, which is becoming increasingly critical to assessing a company’s overall viability.