Discover Sigma's global risk intelligence platform that powers compliant commercial relationships

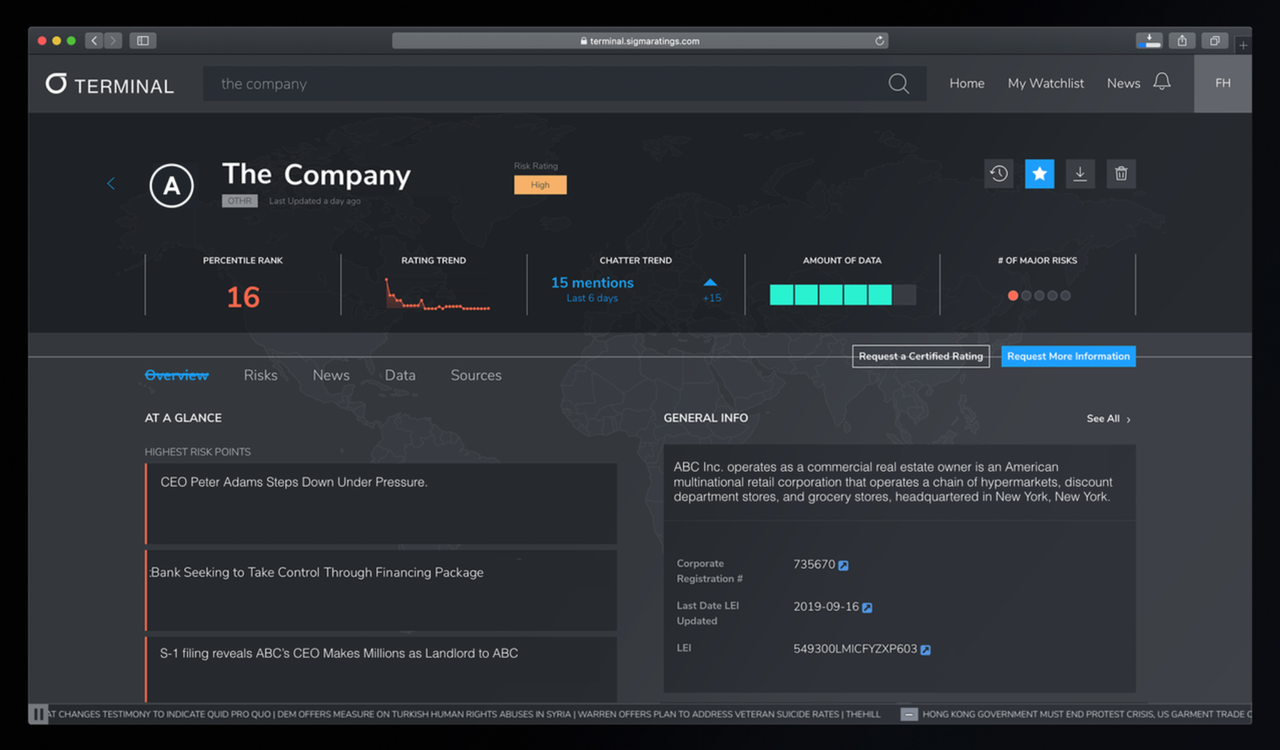

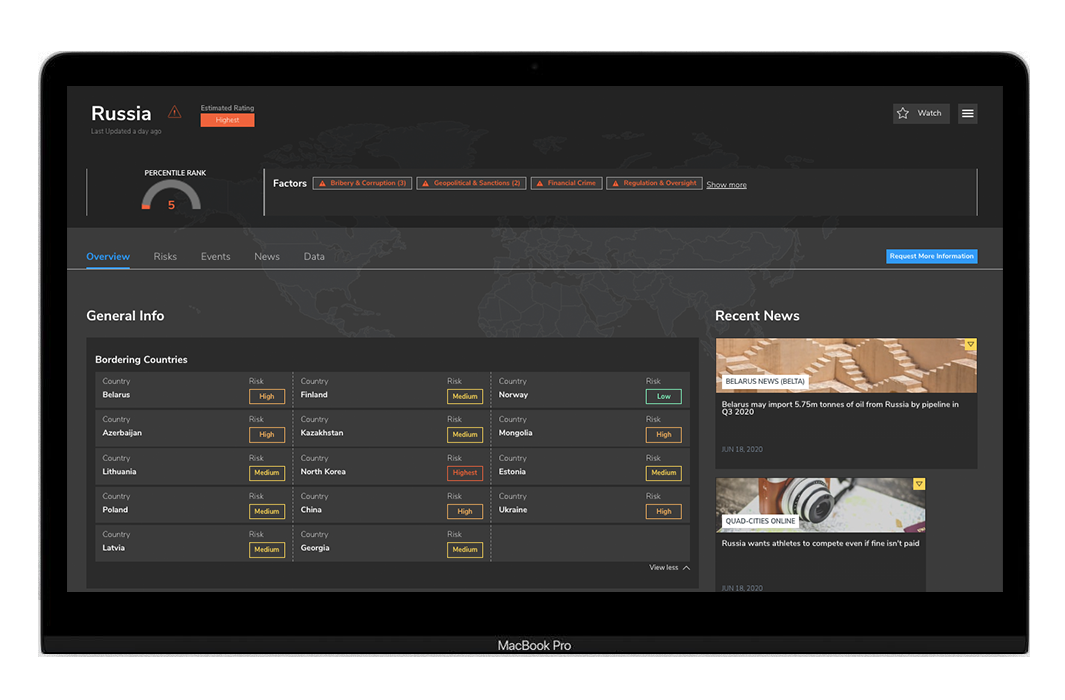

Designed by industry experts, Sigma extracts data into actionable insights, tiering issues by risk level and highlighting the most important flags.

• FAST, TARGETED SEARCHES

• MINIMAL SET-UP TIME

• AGGREGATED DATA

• PROPRIETARY DERIVED DATA

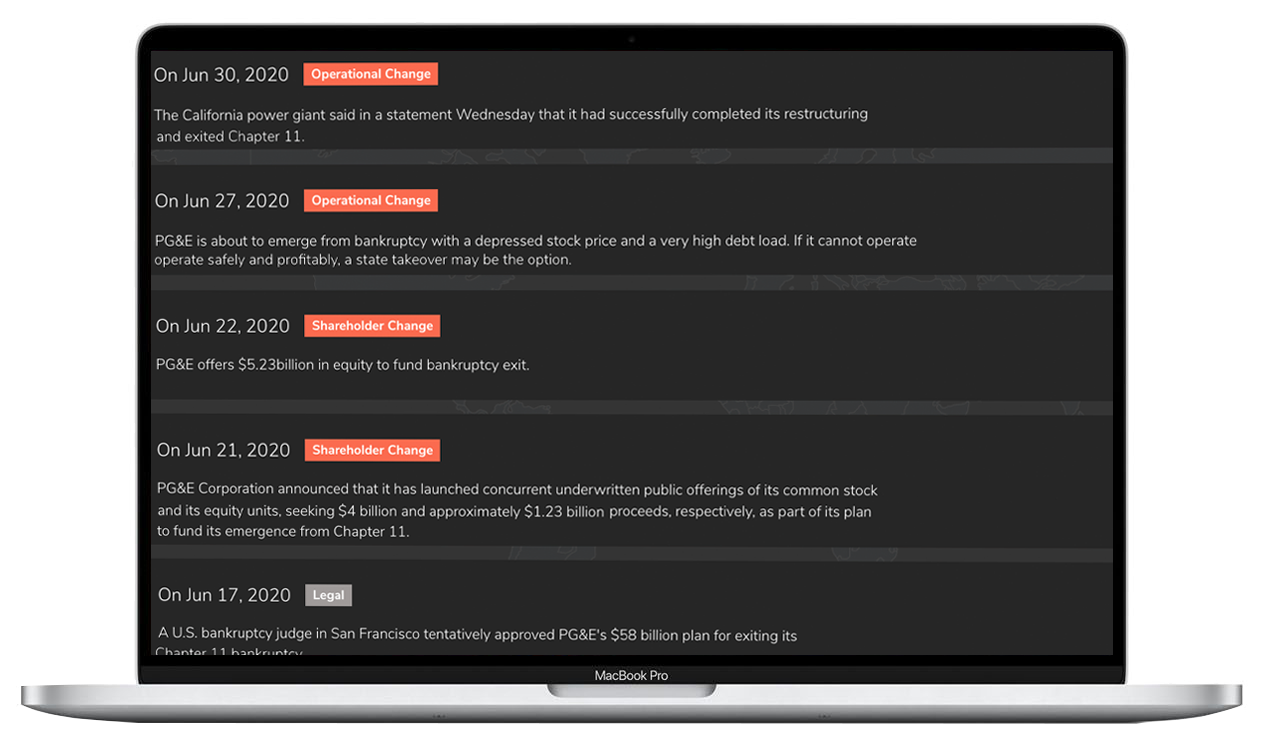

• REAL TIME ALERTS

• REDUCTION OF FALSE POSITIVES

• CONSISTENT VIEW OF RISK ACROSS TEAMS

• INSIGHTS ON OVER 260 COUNTRIES & TERRITORIES

• ANALYTICS FROM GLOBAL INDUSTRY BODIES & INDEXES

• DYNAMIC UPDATES FOR ACCURATE RATINGS

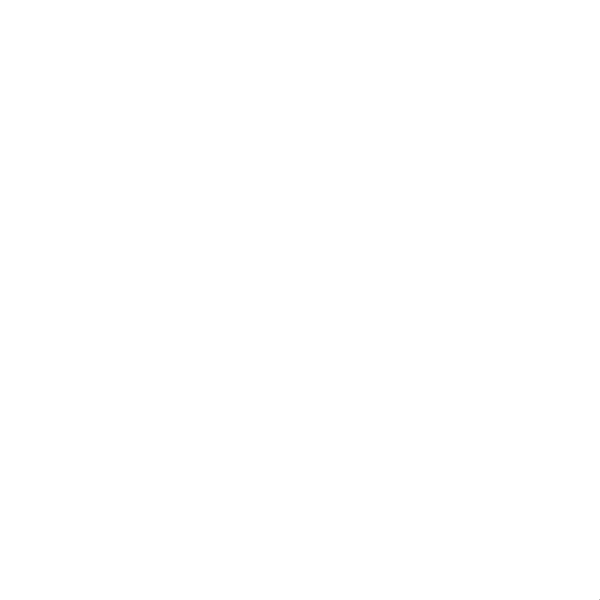

Sigma Terminal offers flexible search parameters that reduce time spent manually gathering data by up to 75% and continuously monitors key data sources to easily alert users to changes in risk.

Sigma API enables seamless integration into existing workflows. Sigma APIs are deployed to (i) automatically screen entities and (ii) provide automated scoring and categorization at scale.

Data Points

Companies & People

Countries

This week, media reports alleged that both the U.S. Department of Justice and the FBI were investigating Danske Bank, Swedbank and SEB over potential breaches of U.S. anti-money laundering regulations and fraud.

This week, both the United States House of Representatives and Senate, through the “must-pass” annual defense spending bill, voted overwhelmingly to finalize reforms to the country’s AML framework through the Anti-Money Laundering Act of 2020 (AMLA).

Developed by the combined effort of our team of dedicated engineers and expert analysts we are so proud to be releasing the Sigma Risk API.