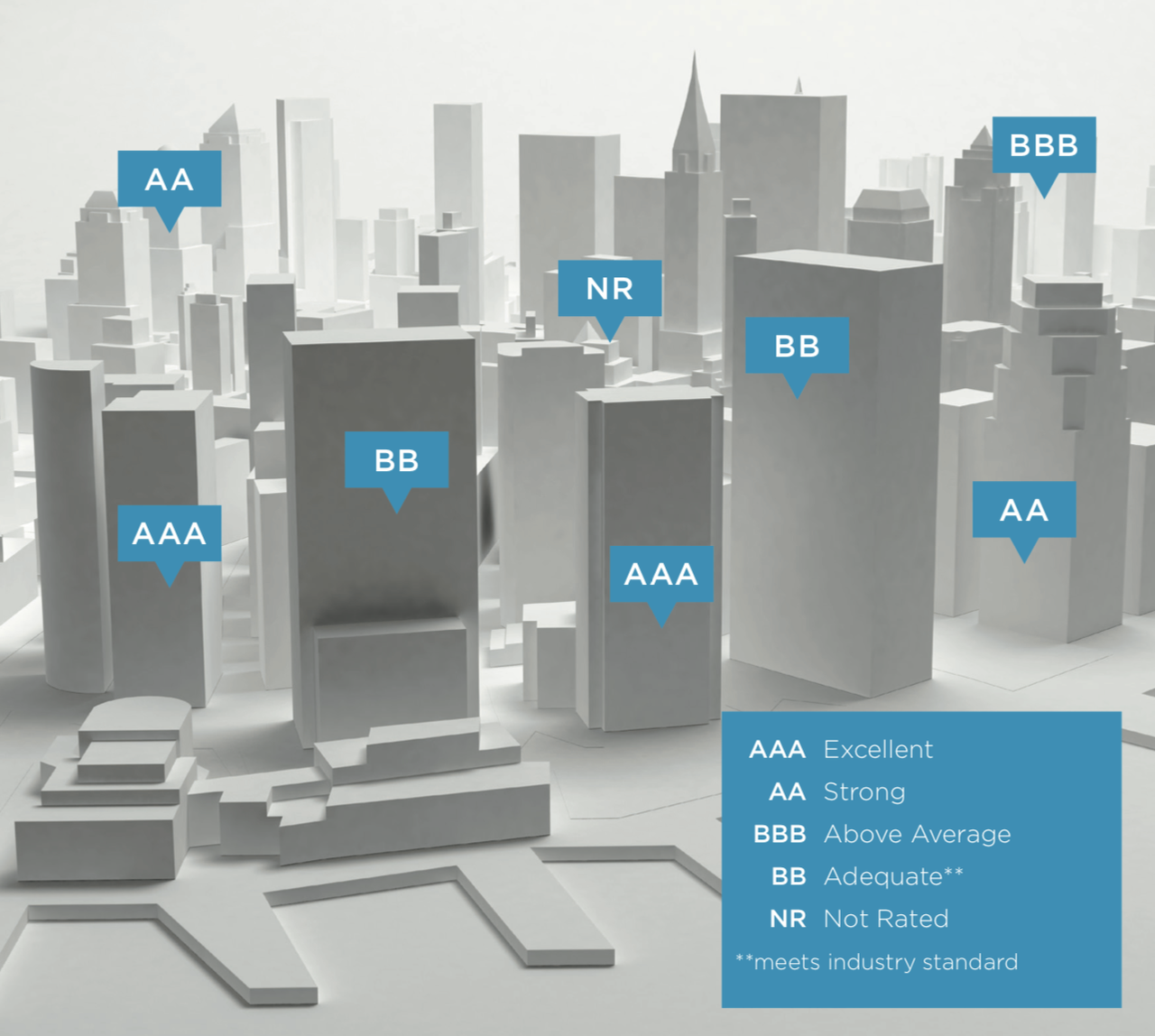

Our model evaluates an entity by comparing its inherent risk against its control effectiveness to produce a letter grade. Our ratings represent a new standard that creates transparency, builds trust, and attracts investment.

Join a growing number of innovative entities around the world who are already benefiting from the rating process.

Build trust, differentiate and gain a competitive advantage through Sigma's Certified Ratings™.

of investors consider a company's reputation as a critical factor in a decision to do business

consider independent assessments when deciding on an invetment or business relationship

of financial services institutions consider conduct risk important when deciding to do business in an emerging market

Global banks, investors, and regulators are using Sigma.

With a Sigma Rating in hand, one can be confident in understanding the risk associated with a counterparty. By acquiring a license to Sigma Terminal, users gain access to thousands of estimated and certified ratings™.

Onboarding a new supplier includes unforeseeable risk, especially in opaque markets. A Sigma Rating takes the guesswork out of the equation and provides the necessary assurance to proceed.

Best practice requires EDD on all clients in high-risk markets. Sigma allows FIs to allocate diligence efforts more effectively, extend refresh deadlines and understand changes more dynamically.

Financial crime, governance, and cybersecurity issues are costing investors around the world billions of dollars. A Sigma Rating allows investors to proactively identify potential risk.