In the wake of recent media reporting and annual reaffirmation that the international community catches only a small percentage of estimated global money laundering, FinCEN solicited comments as part of its Advance Notice of Proposed Rule Making (ANPRM) on AML Program Effectiveness, which was published in the Federal Register on September 17th. According to FinCEN, the proposals being considered are intended “to provide financial institutions greater flexibility in the allocation of resources and greater alignment of priorities across industry and government, resulting in the enhanced effectiveness and efficiency of anti-money laundering (AML) programs.”

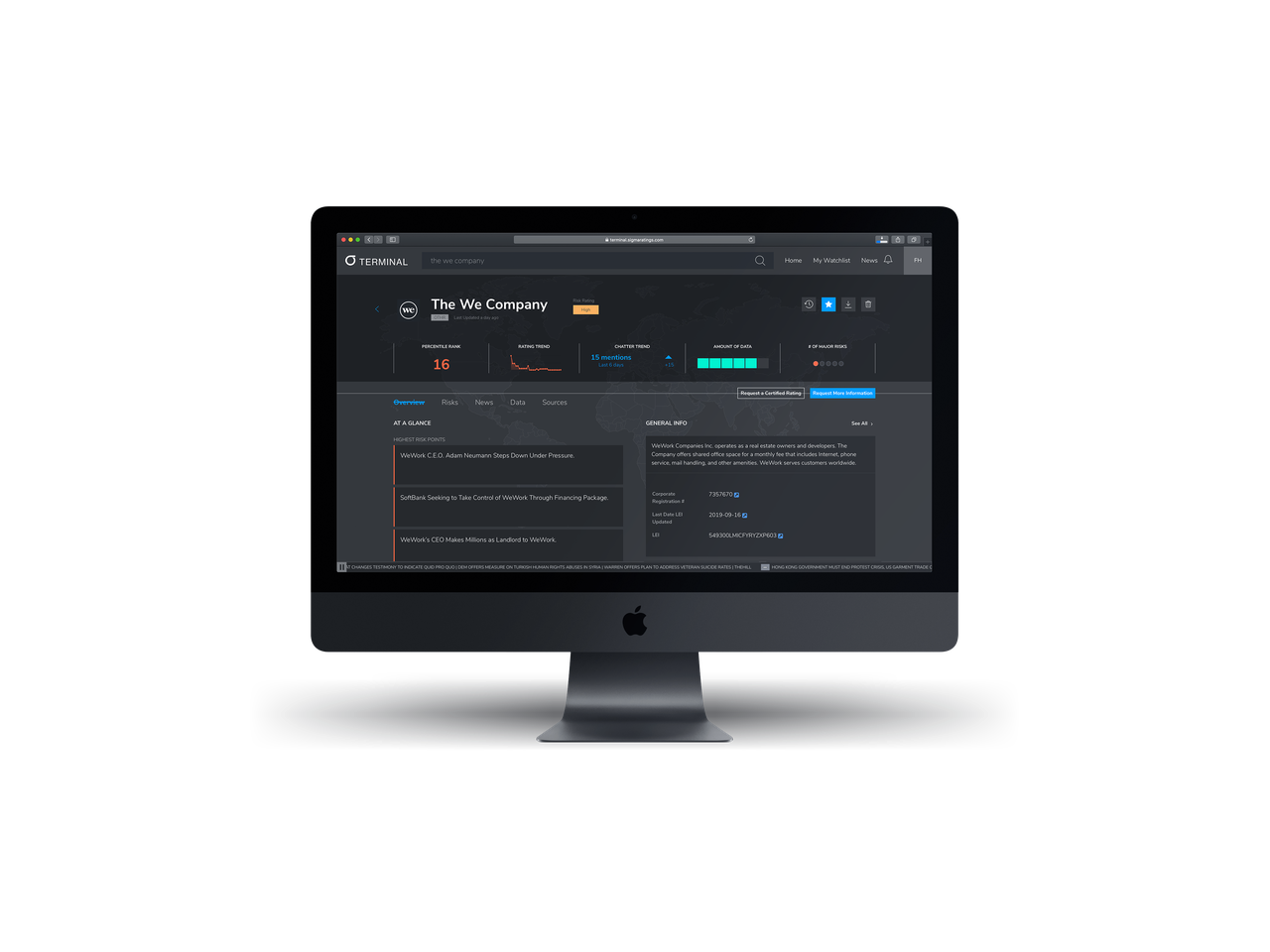

This week, Sigma Ratings submitted its comments in response to ANPRM. In its comments, Sigma agreed with the push to “upgrade and modernize the national AML regime” and specifically sees value in the following key areas where its domain knowledge is most applicable: i) leveraging new technologies to enhance risk management techniques; and ii) discarding inefficient and unnecessary practices. An increasingly technology-enabled approach is something that Sigma has advocated for during the past several years in public hearings and in private briefings with officials in both the legislative and executive branches. Moreover, Sigma believes this approach will benefit significantly from a regularly published list of AML priorities to ensure that both budgets and expectations are aligned for regulated entities, as well as the technology providers building the next generation of AML tools necessary to contribute to the fight.

Sigma strongly believes the steps taken by FinCEN and other U.S. Government agencies around enhancing effectiveness and efficiency are both welcome and timely. In fact, in addition to FinCEN’s ANPRM, regulators from the United Kingdom, and Hong Kong also announced significant reforms in the days prior to the publication of the FinCEN Files. Notably, according to the Financial Secrecy Index, the three jurisdictions account for a 47.96% share of the global total amount of cross-border financial services. As a result, this collective effort to enhance the effectiveness and efficiency of the respective jurisdiction’s AML regime will undoubtedly better safeguard the global financial system against the evolving sophistication of today’s financial crime.